how much tax is deducted from a paycheck in missouri

The federal income tax deduction allows Missouri taxpayers to deduct federal income taxes paid up to a limit of 5000 for single filers and 10000 for joint filers for tax year 2021. Below is some helpful information regarding the military deduction.

Missouri Withholding Tax Compensation Deduction

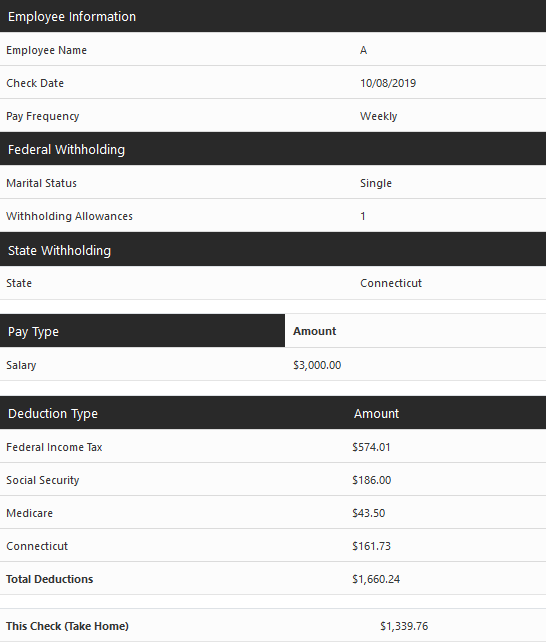

ADP Salary Payroll Calculator.

. Has a standard deduction and no exemption. If you make more than a certain amount youll be on the hook for an extra 09 in Medicare taxes. In Missouri income tax is levied at 25.

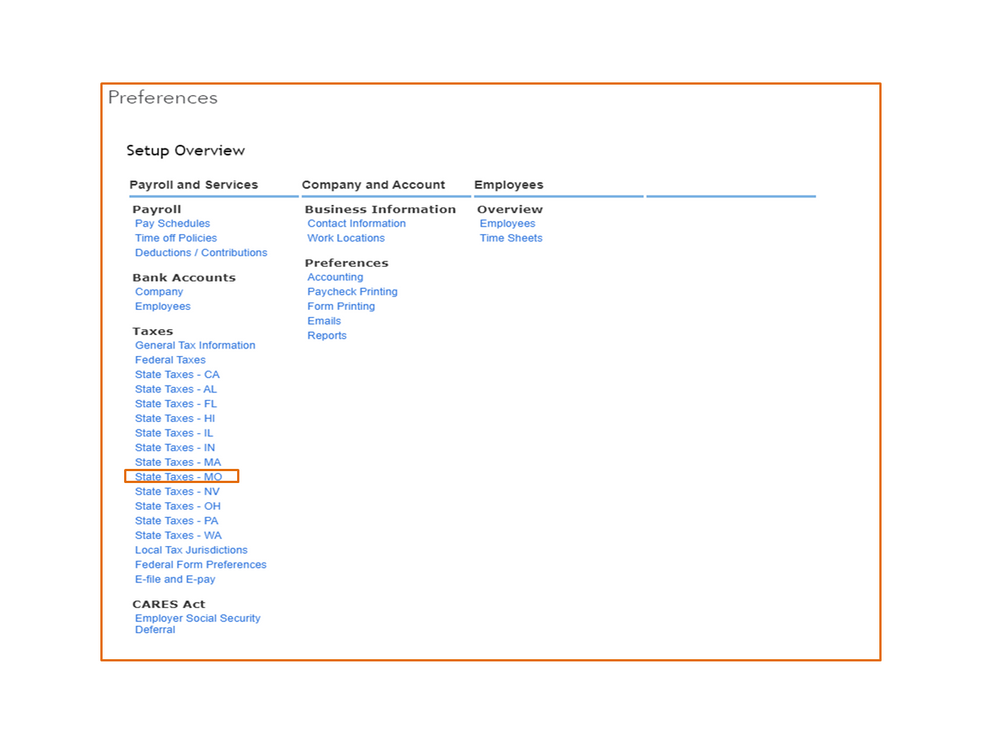

Missouri tax year starts from July 01 the year before to June 30 the current year. The State of Missouri allows a deduction on your individual income tax return for the amount of federal tax you paid. Select your location and add a salary amount to find out how much federal and state taxes.

Louis and Kansas City. No state payroll tax. Employees can use the calculator to do tax planning and project future withholdings and changes to their Missouri W-4.

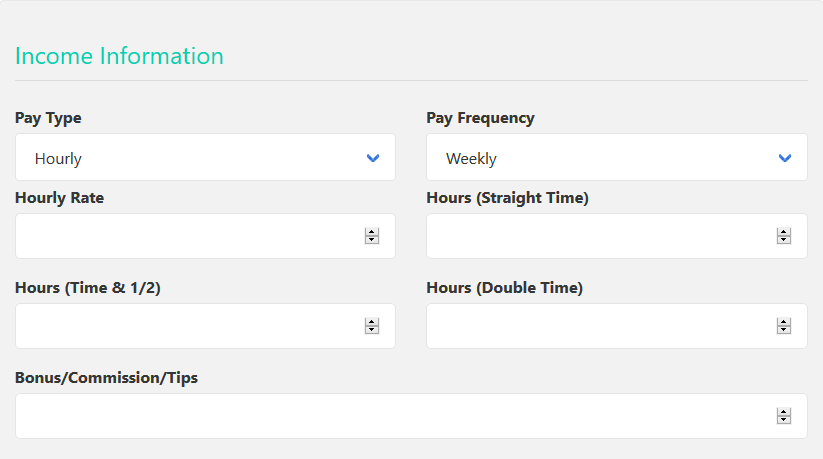

What Taxes Do I Pay In Missouri. Missouri Hourly Paycheck Calculator. The bonus tax calculator is state-by-state compliant for those states that allow the percent method of calculating withholding on special wage paychecks.

Those who contribute up to 2 of their wages or have a wage-based contribution limit must also pay 1 on Medicare. Below are forms for prior Tax Years starting with 2020. Neuvoo Salary and Tax Calculator.

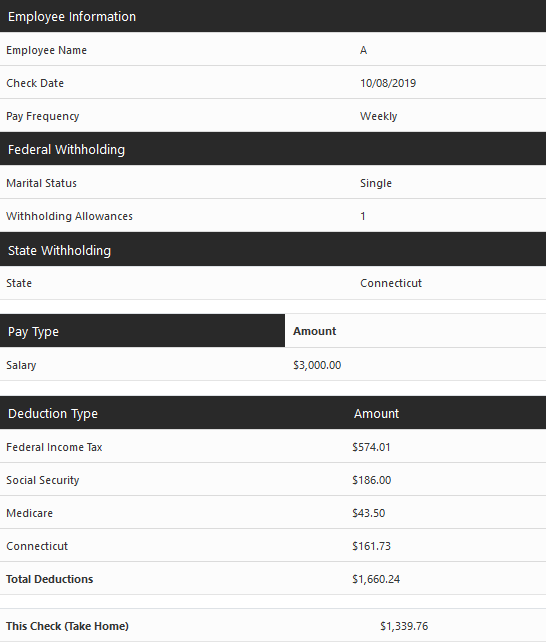

Any company or corporation violating this requirement shall pay each affected person 50 which can be recovered through court action. 145 of each of your paychecks is withheld for Medicare taxes and your employer contributes another 145. How Much Is Supposed To Be Deducted From Paycheck.

Its a progressive income tax meaning the more money your employees make the higher the income tax. The withholding calculator is designed to assist. 31 2021 can be e-Filed in conjunction with a IRS Income Tax Return.

The Missouri bonus tax percent calculator will tell you what your take-home pay will be for your bonus based on the supplemental percentage rate method of withholding. The first step to calculating payroll in Missouri is applying the state tax rate to each employees earnings starting at 15. Switch to Missouri hourly calculator.

Here are some calculators that will help you analyze your paycheck and determine your take-home salary. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information. Section 143174 RSMo provides a deduction for military income earned as a member of the active duty component of the Armed Forces of the United States.

You can claim a deduction against your taxable income in Missouri if you contribute to an Missouri AND non-Missouri 529 plan up to 8000 per year. You will pay 256050 in Federal Tax on a 3600000 salary in 2022. Those working in the private sector are also paying a 6 Social Security tax.

How much Missouri State Tax should I pay on 3600000. You will pay 128337 in Missouri State tax on a 3600000 salary in 2022. An employer may deduct funds from an employees wages for cash register shortages damage to equipment or for similar reasons.

Details on how to only prepare and print a Missouri 2021 Tax Return. Do not use the amount of federal tax withheld from your Form W-2. In addition to the state tax St.

How much Federal Tax should I pay on 3600000. If you are married you can claim a deduction up to 16000 each year. The taxable income for the state is the same as.

In Missouri MO we pay 4 sales tax. Local municipalities can impose as high as a 10 percent tax on any amount. You should use the Line references.

This Missouri hourly paycheck calculator is perfect for those who are paid on an hourly basis. The deduction is for the amount actually paid as indicated on your Federal Form and NOT the amount withheld by your employer that is listed on your Form W-2. A financial advisor in Missourican help you understand how taxes fit into your overall financial goals.

Missouri Income Tax Forms. Add your state federal state and voluntary deductions to determine your net pay. Missouri State Income Tax Forms for Tax Year 2021 Jan.

Employers can use the calculator rather than manually looking up withholding tax in tables. Tax Professionals can use the calculator when testing new tax software or assisting with tax planning. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits.

5 rows What Percentage Is Taken Out Of Paycheck Taxes. A resident of St. Missouris top income tax rate is set to drop to 510 over the course of the next few years.

How did we calculate Federal Tax paid on 3600000. This will happen if the states revenue meets a certain growth rate or level resulting in a triggered tax cut. Calculate your Missouri net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Missouri paycheck calculator.

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. A Social Security tax of six percent is in. In addition any residents as well as.

The top tax bracket is 53 which applies to employees who make more than 858500 annually. Switch to Missouri salary calculator. Payroll taxes and income tax.

Employers withhold or deduct some of their employees pay in order to cover. There is no state requirement for the state and local governments to collect verify or. There is no income limit on Medicare taxes.

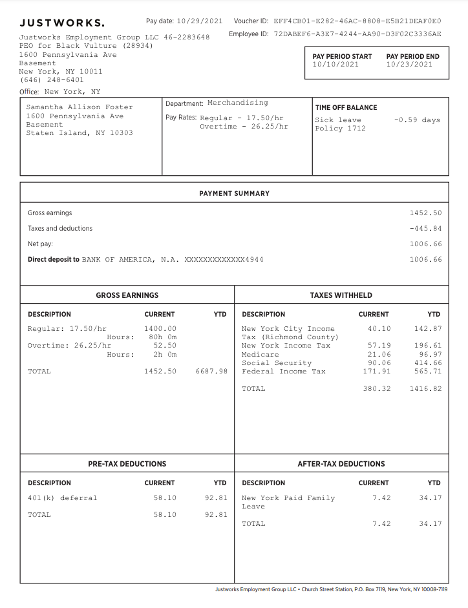

This deduction may be claimed on the Military Income Deduction line of the Missouri Individual Income Tax Return Form MO-1040. The amount of money you. Missouri Salary Paycheck Calculator.

Louis or Kansas City is subjected to local income tax of 1.

Missouri Paycheck Calculator Smartasset

Damians Deductions 1 1 3 Docx Paycheck Deductions All Sorts Of Deductions Are Taken Out Of People U2019s Paychecks Some Deductions Were For The Course Hero

Paystub Generator Build Your Pay Stub Payroll Template Statement Template Business Checks

Ready To Use Paycheck Calculator Excel Template Msofficegeek

Free Paycheck Calculator Hourly Salary Usa Dremployee

Ready To Use Paycheck Calculator Excel Template Msofficegeek

How Many Taxes Are Taken Out Of A 700 Paycheck Quora

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Questions About My Paycheck Justworks Help Center

Ready To Use Paycheck Calculator Excel Template Msofficegeek

What Are Payroll Deductions Pre Tax Post Tax Deductions Adp

Payroll Tax What It Is How To Calculate It Bench Accounting

Understanding Your Paycheck Taxes Withholdings More Supermoney

What Can I Deduct From My Employee S Paycheck Exaktime

Missouri Paycheck Calculator Smartasset

Free Paycheck Calculator Hourly Salary Usa Dremployee

Free Online Paycheck Calculator Calculate Take Home Pay 2022